Do you desperately look for 'sba personal financial statement'? You can find all the material on this web page.

Table of contents

- Sba personal financial statement in 2021

- Sba personal financial statement 2021

- Sba personal financial statement disaster programs

- Sba personal financial statement pdf

- How to fill out sba personal financial statement

- Sba personal financial statement excel template

- Sba personal financial form

- Personal financial statement template

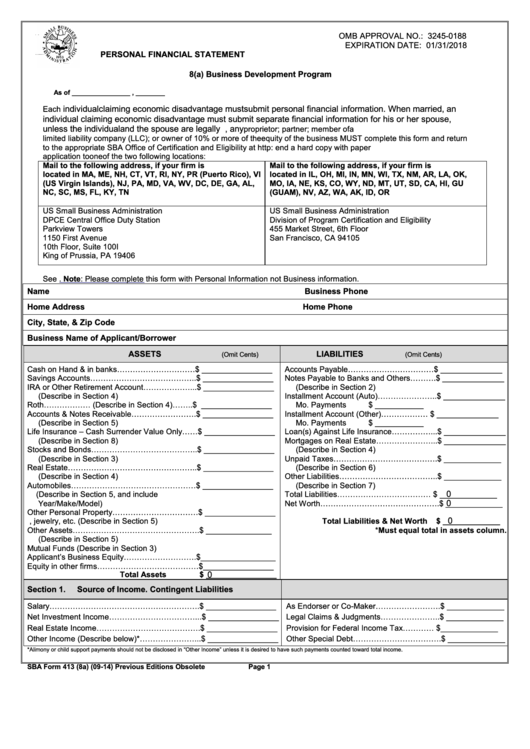

Sba personal financial statement in 2021

This picture representes sba personal financial statement.

This picture representes sba personal financial statement.

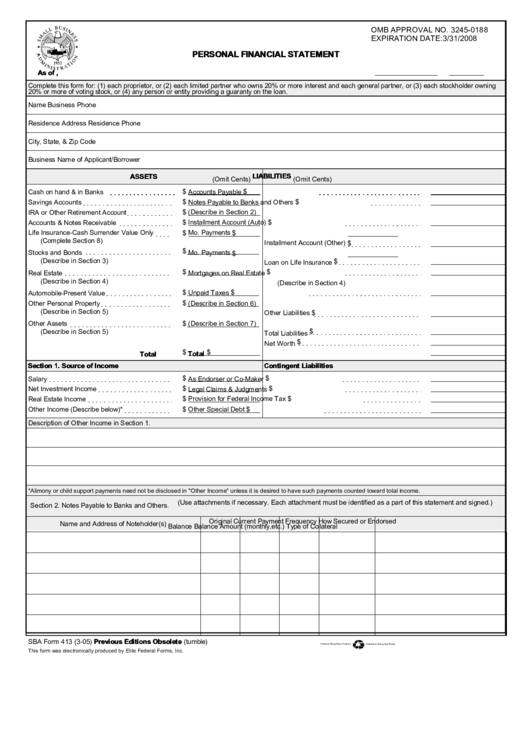

Sba personal financial statement 2021

This picture illustrates Sba personal financial statement 2021.

This picture illustrates Sba personal financial statement 2021.

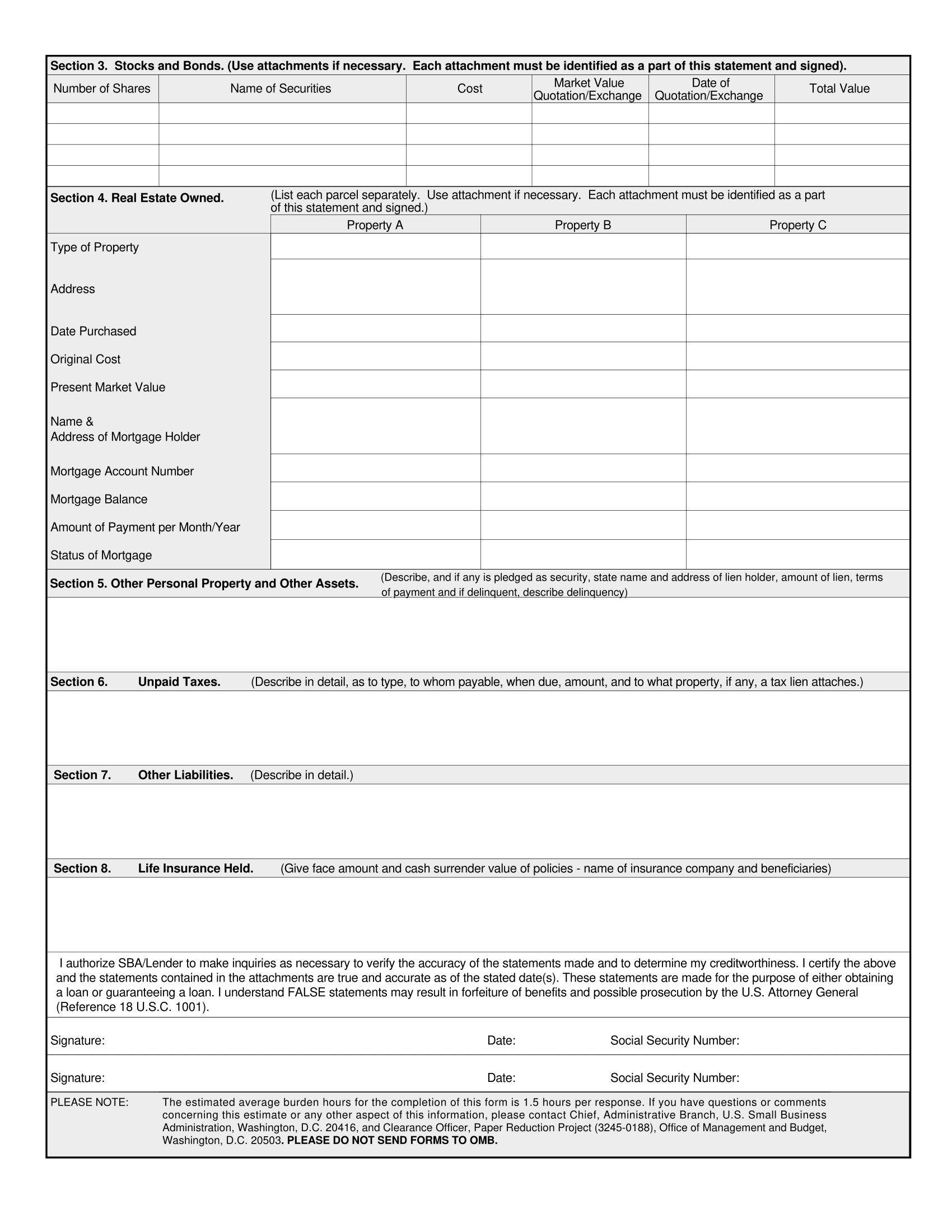

Sba personal financial statement disaster programs

This image illustrates Sba personal financial statement disaster programs.

This image illustrates Sba personal financial statement disaster programs.

Sba personal financial statement pdf

This image shows Sba personal financial statement pdf.

This image shows Sba personal financial statement pdf.

How to fill out sba personal financial statement

This image illustrates How to fill out sba personal financial statement.

This image illustrates How to fill out sba personal financial statement.

Sba personal financial statement excel template

This picture illustrates Sba personal financial statement excel template.

This picture illustrates Sba personal financial statement excel template.

Sba personal financial form

This image illustrates Sba personal financial form.

This image illustrates Sba personal financial form.

Personal financial statement template

This picture representes Personal financial statement template.

This picture representes Personal financial statement template.

What is the best way to fill out an SBA form for a small business?

Get started by making sure your form is the most recent version. You can do this by confirming the expiration date in the top right corner. If your form is out of date, search for the most recent SBA Form 413 on the Small Business Administration's website. Depending on the time of year, the form you find online may not yet have been updated.

What is the purpose of the SBA application form?

The lender uses this form to ensure eligibility for an SBA loan based on their finances. This form has to be provided either by an individual’s lender or individual.

What is the purpose of an SBA form 413, personal financial statement?

SBA Form 413, Personal Financial Statement - 7 (a)/504 Loans and Surety Bonds is a form used to submit personal financial information. This form is used when applying for SBA 7 (a) and SBA 504 loans. The lender uses this form to ensure eligibility for an SBA loan based on their finances.

Do you need personal financial statement for SBA?

With 7 (a)/504 loans, owners with more than 20% equity must provide an SBA personal financial statement. Owners are also called proprietors, general partners, or managing members of an LLC. Furthermore, spouses and children with more than 20% equity must submit personal financial statements.

Last Update: Oct 2021